[wpforo]

When people join forces with a shared purpose, real change happens. Even small actions, fueled by intention and care, can create a powerful impact. Invasive species are advancing faster than ever, threatening the lands, waters, and communities we love.

Your gift today powers rapid response, equips communities, and strengthens our united front to stop the damage before it’s too late. Every moment counts – let’s act now to protect a thriving, resilient B.C.

“I have had a wonderful experience of growth and connection through the ISCBC youth program… It has been a pleasure to contribute to the important environmental work happening in my community…”

“I can sincerely attest to the fact that the ISCBC efficiently utilizes funding in the most innovative and effective ways. I know that my donation dollars are going to go to work right away and will make a difference…”

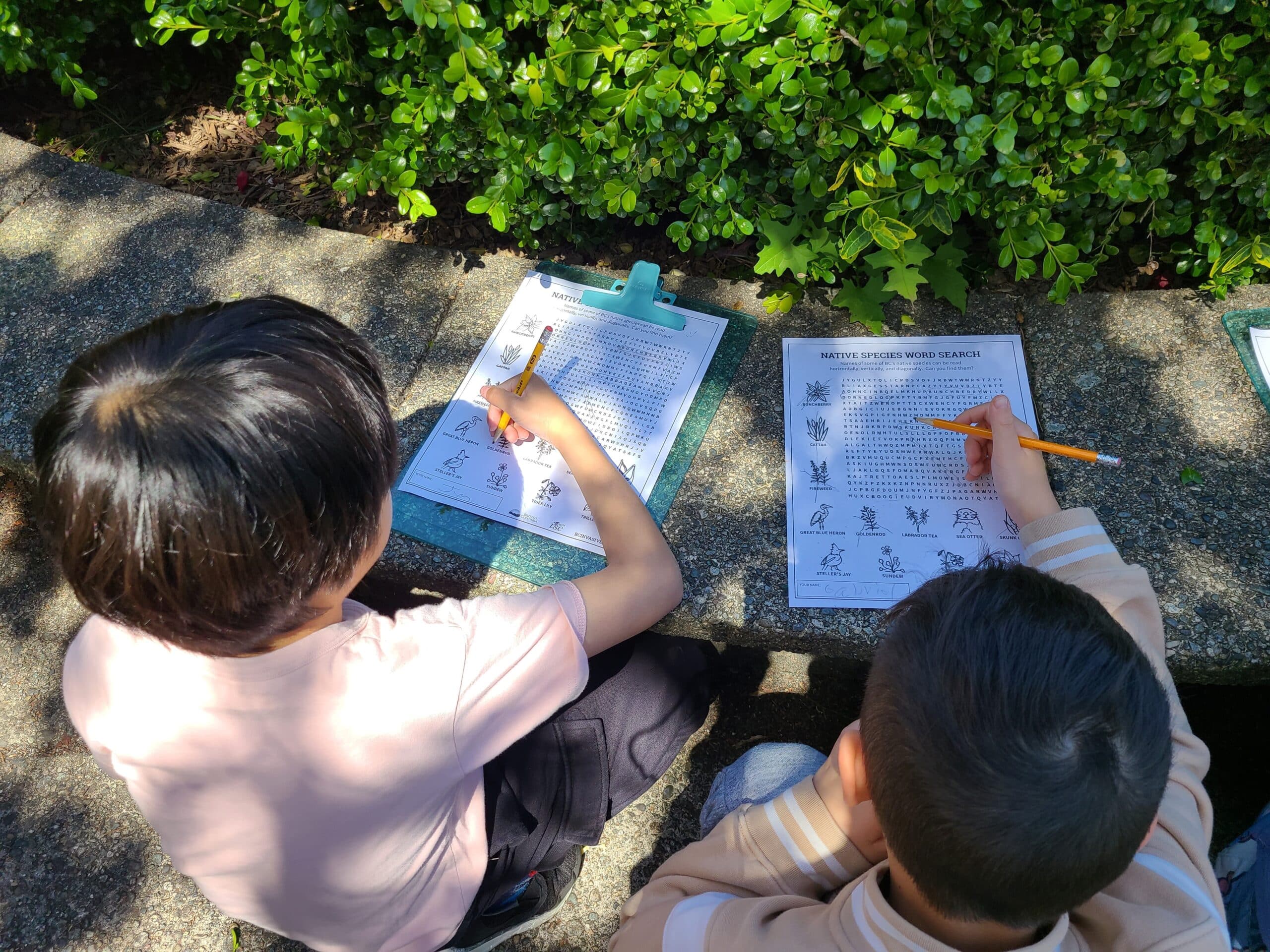

“The resources and workshops provided by the Invasive Species Council of BC are excellent tools and offered our class an in-depth, interactive, and meaningful learning experience.”